AB Mobile is a free service that gives you access to our most frequently performed banking tasks from the convenience of your mobile device. You will be able to access many of the features available to you on Amalgamated’s Online Banking, such as account information (balances and transactions), bill payment, transfers, ATM and branch locators and contact information. The service is available in three convenient ways:

- Mobile website

You can simply go to www.amalgamatedbank.com on your mobile web browser. - SMS text (Please Note: carrier text and data usage charges may apply.)

Send and receive texts to quickly see account information and do transfer without signing on to web or app. - Mobile application (app)

Mobile applications which are optimized for smartphones and iPad® devices, provide quick access to account information and mobile check deposit.

|

The mobile application appears as below in the Apple App Store |

The mobile application appears as below in Google Play |

|

|

Click here to read additional information on Mobile Banking.

You may deposit checks into most personal, small business and commercial Checking, Savings or Money Market accounts.

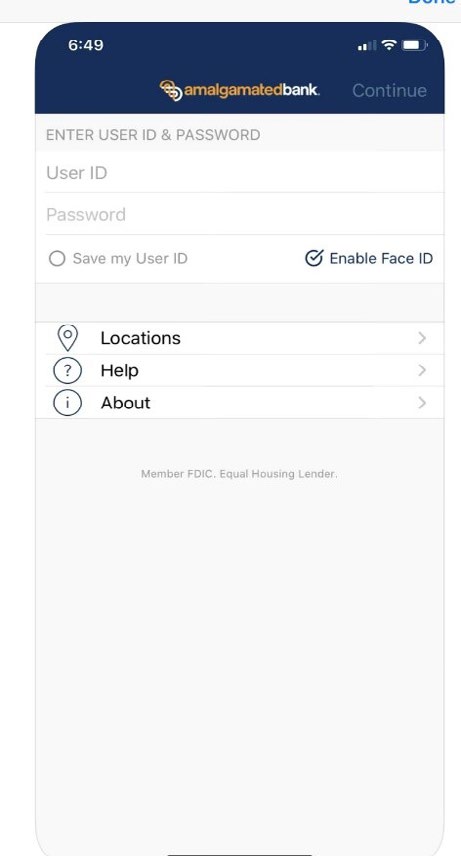

Any personal customer who uses Amalgamated’s Online Banking today can use AB Mobile. The same credentials used for Online Banking are used for Mobile Banking. Customers who do not have Online Banking, but who want the convenience of Mobile Banking must first enroll in Online Banking at www.amalgamatedbank.com.

Click here to read additional information on Mobile Banking.

Mobile Check Deposit is currently available through the downloadable application (app) for iPhone®, iPad® and Android™. For consumers, Mobile Check Deposit is automatically included when you use the application after successful login; no additional enrollment is necessary. If you are a Treasury client, your account administrator must enable you.

- AB Mobile App iPhone®, iPad®, iTouch® and Android™ (various phones)

- AB Mobile Web Any iOS, Android™ phone, or tablet with a web browser

- AB Mobile Text Any SMS-enabled phone

Click here to read additional information on Mobile Banking.

To use Mobile Check Deposit, you must be a current Amalgamated customer with an eligible Checking, Savings or Money Market account. You must be enrolled in Online Banking and download our Mobile App. If you are a Treasury client, your account administrator must enable you. Before depositing your first check, you must read and accept the Mobile Check Deposit Services disclosure and agreement.

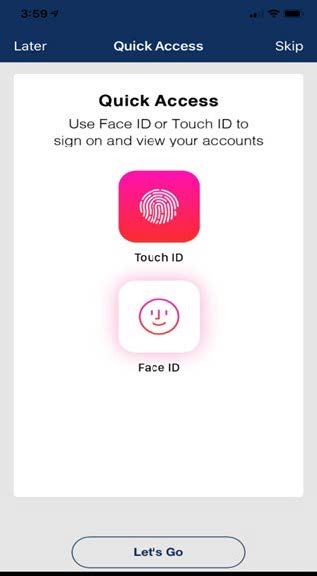

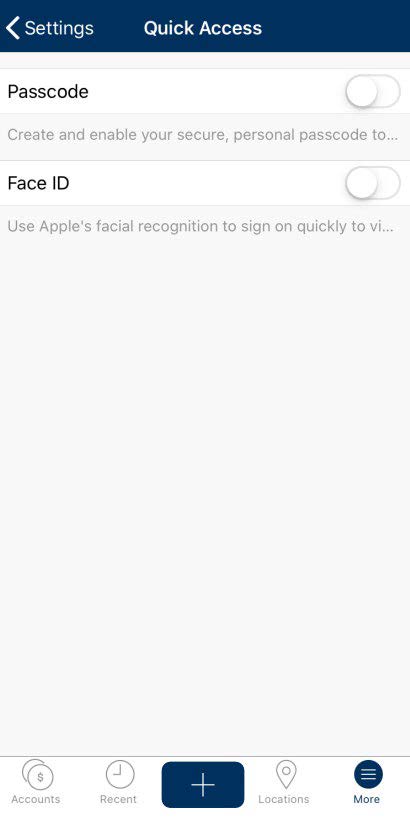

Amalgamated Bank now offers you the ability to log into our Mobile Banking app using the fingerprint scanner on your iPhone® (iPhone® 6S and newer only), Face ID, or a six-digit Passcode.

Mobile Check deposit is a free service that is included in the Mobile Banking and Amalgamated Treasury Mobile applications. It allows clients to deposit checks electronically using the camera on their iPad®, iPhone® or Android™ mobile phone or tablet device. Please Note: carrier text and data usage charges may apply.

Touch ID/Face ID and passcode is a secure means of accessing your account. The app will only log you in once your unique fingerprint, face or passcode is verified. Even if your Passcode is compromised, Mobile Banking sessions initiated via Touch ID/Face ID and passcode are “read-only,” meaning that no transactions can be performed without the app first requiring your full Online/Mobile Banking User ID and Password.

Once you log into the Mobile Banking app, you will see a screen entitled, “What’s New.” Users of the iPhone 6S and newer will see walk-through Touch ID configuration instructions while all other iPhone®/Android™ users will see the Passcode walk-through configuration screen. Follow the on-screen instructions to set up Touch ID/Passcode access. If you do not wish to configure Touch ID/Face ID and passcode access, simply tap “Skip” in the right corner of the screen. Three ways to log in to Mobile Banking: (iPhone® 6S and newer)

1. Username and Password

2. Passcode

3. Biometrics

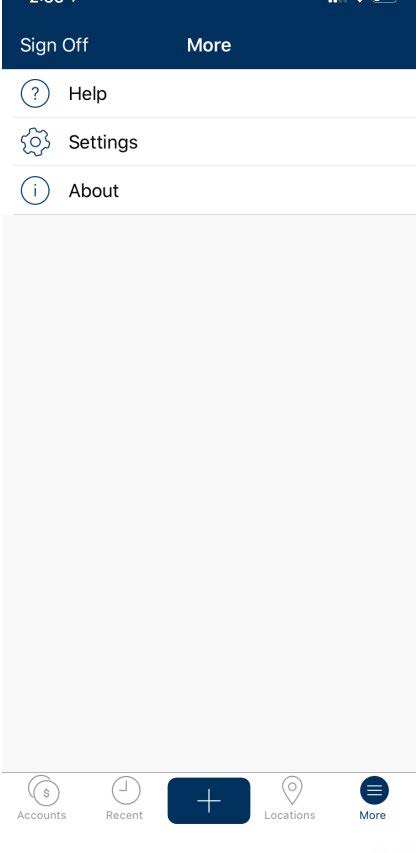

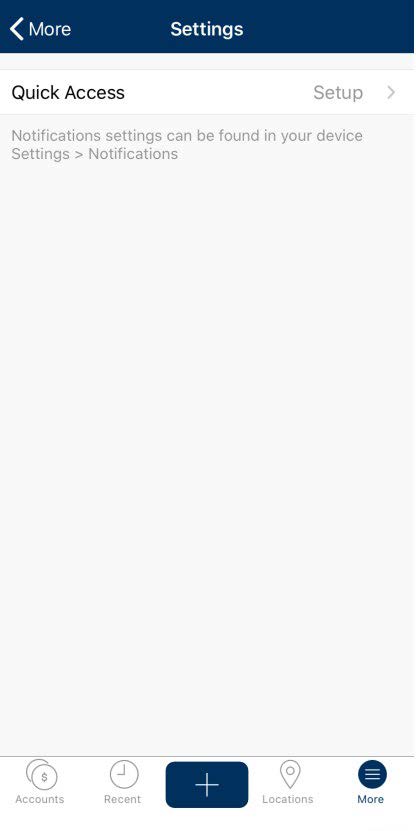

Passcode/Face ID/Touch ID maintenance is performed within Mobile Banking Settings. Settings can be found in the app’s Main Menu. The Settings page requires full login authentication. If you did not access Mobile Banking via full login authentication, you will be prompted for your User ID and Password. Once authenticated, you will be presented with the Settings where you can see if Passcode/Face ID/Touch ID is currently on and disable or change the Passcode/Face ID/Touch ID. (iPhone® 6S and newer)

Signing on with biometric authentication, such as your face or fingerprint, provides secure, quick, and easy access to a subset of features, such as account balance information. Signing on with a passcode allows you to quickly access a subset of features, such as account balance information.

You may call Amalgamated Support at 1 (800) 662-0860. Support is available M-F from 8:00am – 8:00pm ET and Saturdays from 9:00am – 2:00pm ET. If you are a Treasury customer, you may call 1 (866) 542-8788. Note that hours are subject to change. For the most up-to-date hours, please click here.

Please refer to Amalgamated’s Funds Availability Guide for information about deposits.

You will see a credit to your account once the deposit has been approved by the bank. Your check will be processed by Amalgamated on the same business day if received before 3:30pm ET. If received after 3:30pm ET on a business day, weekend or holiday, it will be processed on the following business day. Please do not dispose of your check or attempt to process at another institution or through another channel (ATM or in-branch).

There are a few common errors that may cause your check to be rejected:

-

Folded or torn corners

-

Front or back image is not legible

-

Missing endorsement

-

Routing and account numbers are unclear

-

No camera on the device

-

Image is too dark

Try using Mobile Check deposit in a well-lit area to prevent shadows and poor image quality. Keep your hands clear of the check while taking the picture.

Original checks drawn on U.S. financial institutions in U.S. dollars, which are payable to and endorsed by the depositor, and include the words, "For Mobile Deposit Only at Amalgamated Bank," can be deposited.

The following items should not be deposited through Mobile Check Deposit:

- Third-party checks (checks payable to any person or entity other than the person who owns the account into

which the check is being deposited) - Checks payable on sight, payable as cash or payable through Drafts

- Checks containing an alteration on the front of the check, or which you know or suspect, or should know or suspect, are fraudulent or otherwise not authorized by the owner of the account on which the check is drawn

- Checks payable jointly, unless deposited into an account in the name of all payees

- Checks previously converted to a substitute check, as defined in Reg CC¹

- Checks not payable in United States currency

- Checks drawn on a financial institution located outside the United States

- Checks dated more than six (6) months prior to the date of deposit

- Checks with any endorsement on the back other than that specified in our agreement

- Checks that have previously been submitted and accepted through our service or through a remote deposit capture service offered at any other financial institution

- Checks or items that are drawn or otherwise issued by the U.S. Treasury Department

- Any item stamped “Non-negotiable” or “This is not a check”

- Bonds

- U.S. Postal or Western Union Money Orders

- Traveler’s Checks

- Checks drawn on the United State Treasury

1 12 CFR 229.1

Retain the original check in a secure location for thirty (30) days following receipt and credit of the deposit to your account. We recommend you completely destroy each original check after this retention period. A paper shredder is a good method for secure destruction of original checks.

When you submit a check image through Mobile Check Deposit, you will receive an email confirmation that your deposit has been received. You will then receive a second email confirmation when your deposit has been accepted by the bank. (Please note: additional processing of your deposit may still be required.)

Standard Business and Commercial Banking Limits: $20,000 daily, not to exceed $50,000 over a rolling 25 business day period

Standard Consumer Limits For Accounts Open Less Than 90 Days: $3,000 daily, not to exceed $10,000 over a rolling 25 business day period.

Standard Consumer Limits For Accounts Open Over 90 Days: $5,000 daily, not to exceed $20,000 over a rolling 25 business day period.

There are no restrictions to the number of checks deposited as long as the deposit limit is not exceeded.

Mobile check deposit is free to Amalgamated Bank customers.* Just download the Mobile app to begin.

* Please note that charges from your wireless carrier may apply. Regular account charges apply.